You have heard it said many times:

“Stay away from debt.”

”All debt is bad.”

It sounded like great advice, especially having come from well-meaning people. If you are like me, you lived a great portion of your whole life with these generalized beliefs. For me, in many ways it was great. I saved as much as possible from my income and avoided debts like the plague.

But what about when it was time to start building wealth?

I saw three primary paths to wealth building: starting a business, investing in stock, or investing in real estate. Because I was so intent upon not violating the above rules, I had great limitations to getting started on the path towards wealth. Heck, I needed cash and needed to avoid debt. So, what did I do?

I dabbled in stocks and shortly thereafter became discouraged.

- I could not grow my wealth significantly because I needed lots of cash to control lots of stock.

- Stocks are volatile and I could not go one day without looking at my account 25 times.

- I had no control over the emotion in the marketplace that drives the volatility

- I could not influence management on decisions unless I had a majority share (back to first point).

- I could not leverage positions to gain greater control, aside from options, which are risky according to my risk profile (again, back to first point).

What options for wealth building exist when your two universal rules are to have lots of cash and avoid debt at all times?

I wondered this, so then I started to question this boxy principle. I looked for examples from wealthy people and institutions:

- Our biggest banks have debt on their balance sheet. Bank of America has nearly $300B in debt but $700B in cash;

- Amazon has $63B in total debt and $96B in total assets;

- Berkshire Hathaway, the massive holding company created by the legendary Oracle of Omaha, Warren Buffet, has $40B in debt with an amassed $64B in cash;

- The Blackstone Group, an investment firm, has $12B in total debt and $32B in total assets;

- Mark Zuckerberg, one of the world’s wealthiest people, purchased a house with a mortgage

Note: the “B” after these numbers stands for Billions

I noticed that the wealthiest organizations and people have debts that they can cover with their assets immediately pay off in cash, but chose not to do so. This example taught me that debt can be an amazing tool for creating wealth, but…

Why on earth would one of the world’s richest men get a mortgage?

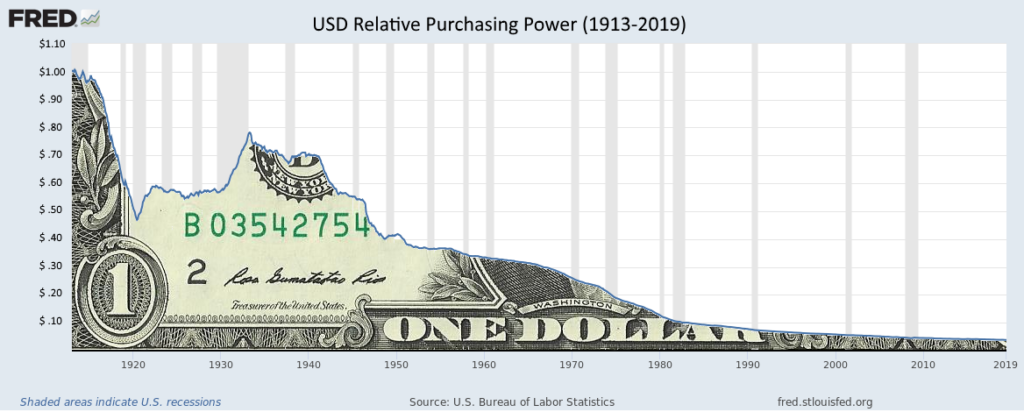

It all comes down to the dollar and its valuation. A more thorough explanation centers around confidence in the dollar based on its history. For the last hundred years, the value of the American dollar has been on steep decline and history shows one thing…that that trend ain’t changing. By securing a mortgage, you are locking in a fixed debt against the continuous decline in the purchasing power of the dollar. Zuckerberg knew this.

See below for reference.

Using debt as a tool

So when we recognize that the dollar is on a continuous decline, we should understand the benefits of debt as a tool. Debt allows you to essentially short the dollar. By locking in a fixed rate (which are currently very low!) you are obtaining a debt in today’s dollars that will be paid down in the future with lesser valuable dollars. The advantage of doing this is that you are paying a fixed debt while the purchasing power of your dollars continues to decline (meaning you would have to pay more dollars for the same good or service in the future). Meanwhile, the value of your property is likely to increase in time while your debt on the property decreases (Read 4 Wealth Builders of Real Estate).

These benefits are precisely while debt is a fundamental tool for real estate investing. If you live in a box of generalized beliefs about money and debt, you will never explore these tools and experience the benefits.

When you hear people criticize the large debts of well-known real estate investors, think again before you buy into it. Their balance sheet may have loads of debt, but that debt is a cash generating tool for wealth building. What you do not see is the cash and other assets they have, which far exceed those liabilities, allowing them the sizeable net worths they have achieved.

What does debt and beer have in common?

When you think about debt, recognize that it is not the one size fits all situation that personal finance leaders have described. Like alcoholic drinks, its use can be abused and deadly. So for many, the advice to stay away altogether is great advice.

But for those who have already achieved discipline of avoiding hampering debts such as credit card debt and large car loans and want to take their personal wealth to the next level, open your mind and consider the unique benefits of leverage in real estate. Otherwise, you could be missing out on a primary tool for massive wealth building.