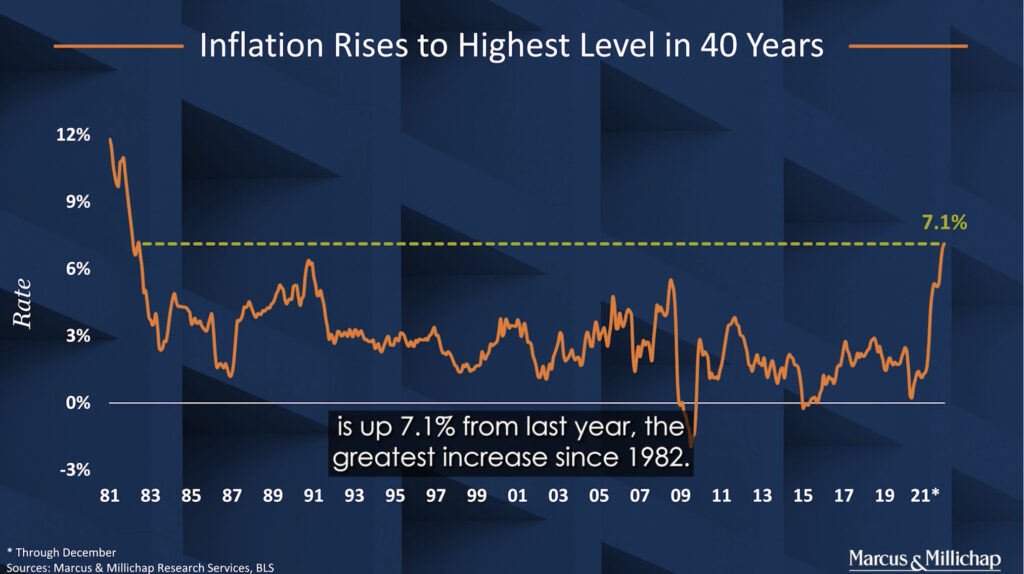

Friends, check out this video from Marcus and Millichap. Inflation, measured using the Consumer Price Index (CPI) is up 7.1% from last year. This is the greatest gain since 1982!

According to Marcus and Millichap, the following are the top 3 drivers for inflation:

1️⃣ Supply Chain Problem

The global supply chain problem is not new but has been exacerbated as a result of COVID. Materials such as steel, lumber, vehicles, shipping containers and computer chips are generating longer lead times due to prolonged delivery schedules. In fact, compared to pre-pandemic, the total amount of materials shipped by truck are down 5.1%. Retail spending is up while shipments are down. In other words, demand cannot meet supply and prices are going up.

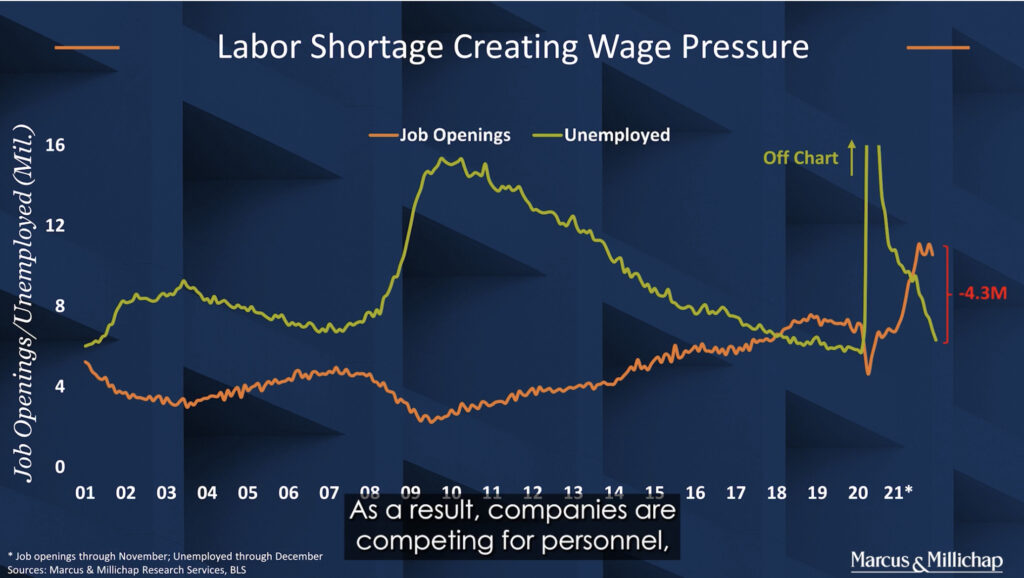

2️⃣ Labor Shortage and Rising Wages

Based on the numbers, the US has not seen a labor shortage to this scale. As the chart shows below, there is a 4.3M labor shortage nationwide. As a result, companies are competing for the same fixed amount of employees and, as a result, driving wages upward. Average hourly earnings are up 5% compared to last year.

3️⃣ Housing Shortage

Looking for a house? Good luck. According to the data, there are not enough houses to buy or rent right now. According to Marcus and Millichap, compared to the ideal 4-6 months of supply of homes for sale on the market, we currently have 2 only months of supply (1 million houses) of homes on the market. As you can figure, this shortage drives home prices. On the renter side, evidence of the shortage is the all-time vacancy rate of 2.6%!

Why Is Inflation Important?

These are very interesting times. Inflation is expected each year, but these levels of inflation, matched with no additional increase in goods and services, creates a bigger problem for the economy.

Based on the current 7.1% reported inflation, in real terms, without raises, our incomes are 7% worse off. Without investments, our assets are worth 7% less.

As you can see, inflation is a real destroyer of wealth for the unsuspecting middle class American citizen. As a result, wise stewards of their wealth should look to asset classes proven to pace and beat inflation, real assets such as multifamily real estate.

💡Invest Your Retirement w/ eQRP

– How To Use Your 401k To Invest In Real Estate