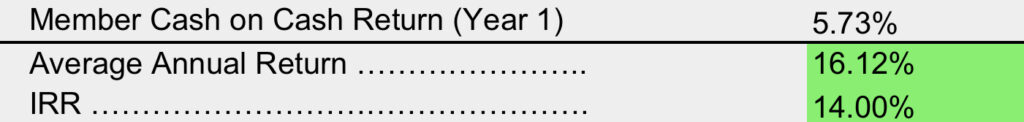

As passive investors in real estate syndications, the amount of jargon can be overwhelming. Specifically, when it comes to investment returns, there are multiple ways to measure the potential wealth creation from an opportunity. Most commonly are three metrics: Cash on Cash Return (CoC), Average Annual Return (AAR) and the Internal Rate of Return (IRR).

Cash on Cash Return (COC): This metric is simply ratio of additional cash received from the investment in relation to the invested principal; For example, if an investor invests $50 and gets $60 back, the cash on cash return is 20% ($10 additional dollars divided by $50 initial principal). As you can expect, with apartment investments, the numbers are larger but the concept is the same.

Average Annual Return (AAR): AAR is simply the return on investment measured on an annual basis. This is calculated as the total investment return divided by the number of years the investment was held. For example, if the initial investment is $50 and it earned $100 after five years, AAR would be 10% ($50 ROI divided by five years).

Internal Rate of Return (IRR): IRR can be considered the standard metric used by sponsors. The purpose of IRR is similar to that of the Average Annual Return (AAR), but takes into account the the time value of money. Because this can be a complicated metric to understand, below is a definition of IRR directly from Investopedia (read full explanation):

The internal rate of return is a metric used in financial analysis to estimate the profitability of potential investments. The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows equal to zero in a discounted cash flow analysis. IRR calculations rely on the same formula as NPV does.

- IRR is the annual rate of growth an investment is expected to generate.

- IRR is calculated using the same concept as NPV, except it sets the NPV equal to zero.

- IRR is ideal for analyzing capital budgeting projects to understand and compare potential rates of annual return over time.

This calculation that helps investors compare investments to alternative investments. Many investors use a minimum IRR as their “hurdle” as one of a few benchmarks to determine whether the opportunity supports their investment criteria.

⚠️ Warning!

Please caution yourself not to accept the metrics as the gospel when sponsors share potential investment opportunities. The projected investment returns are only as good as the assumptions used to create them. For example, if rent growth is aggressively estimated at 5% annually, unless the sponsor and property management team can pull it off, the targeted IRR of 20% will not happen. Do not select the investment simply because it has a high IRR without understanding the underwriting from which it is derived.

💡 Get Practice

Do not let these metrics overwhelm you. Two of them are simple. While the last metric, IRR, is certainly not one to calculate by hand, it is one of the most commonly used metrics in apartment investing and can be used to compare to other investment opportunities. With this in mind, the most important takeaway from this article is to familiarize with the three common metrics and most importantly, the deal itself and how aggressive or conservative the estimated returns are projected.