For anyone familiar with Dave Ramsey’s teachings, a very core area of his financial peace guidance is to get out of debt. The strategy and phenomenon he uses to describe this is the Debt Snowball. Here’s how it works.

Debt Snowball

When you commit to paying of your personal debt, start by paying the lowest balance first. That initial step will be hard. You have to find the extra money, make those payments, be patient and commit to the outcome. But…

Over time, that first debt is paid off.

Then what?

You apply the same focus and effort to the second-largest debt until that is paid off and so on to the other debts, until all that useless, enslaving debt is gone.

I will add along the way to celebrate. This will keep your efforts exciting as you are recognizing successs in getting over that big mountain.

My Wife and I Did This

With nearly $60k in debt after college, we were very discouraged at the effort and time required to live freely the way that Dave Ramsey described. Our friends were buying cars and nice things; meanwhile, we were living on a shoestring budget and trying to pay off debt. Talk about the feeling of missing out.

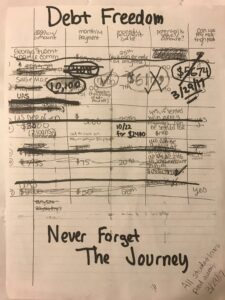

But we kept at it, celebrating with dinners and outings with each success. Finally in 2017, we paid off all that debt and felt like champions! I decided to keep the hand written debt-tracker as a reminder for where we have come from and how hard we have worked to get out of the trap that hampers wealth creation. Check it out:

Wealth Snowball

After spending time basking in our newfound debt freedom, we knew we couldn’t stop there. It was now time to focus on next-level thinking. It was time to create wealth. This is when began focusing my efforts on applying the knowledge gained from reading real estate and taking action. Two rental properties later, we are experiencing what I like to describe as a wealth snowball. Here’s how it works.

Just like in the debt snowball, the effort and time taken to pay off the first debt is tough and discouraging. Saving for the down payment for the first rental property can be harder than saving for your first house due to the higher down payment required for the investment property.

However, after getting to that milestone and buying your first rental (buy right), successfully renting and collecting cash flow, you now have a savings account that is growing each month. After allocating a portion of that income to repairs and maintenance (always plan for this), save the cash flow for reinvestment. Use that and other income to prepare for your next investment. This happens at a faster pace and is what many refer to as the Law of the First Deal.

After securing your second stabilized rental, you are now earning income from two sources! Imagine the effects repeating this cycle. Even conservatively, if you buy a house every year or two, the passive income stream continues to multiply. And recognize that at this point I am only talking about income. I am not even referring to the other powerful wealth builders of real estate, such as appreciation and debt-pay down. With focus and dedication, following the wealth snowball, your net worth can grow by over a hundred thousand dollars, much faster than your 401k’s.

Now you can see how real wealth is created in real estate! To add to this illustration, let’s imagine the added wealth building potential of multi-family real estate versus single-family homes. You are now introducing more doors and income sources per transaction, economies of scale (all operations under one roof) and faster appreciation through raising rents and lowering expenses!

One Step At A Time

Whether you are paying off useless debt to get back to even or ready to build wealth, we all have a next step. Make your journey your own. Do not compare your life and situation to the Jones’ across the street. Instead, follow others who are where you want to be, practice extreme focus and discipline and celebrate along the way.

One step at a time!

💡Invest Your Retirement w/ eQRP

– How To Use Your 401k To Invest In Real Estate